Instruments

- Complex securities and embedded derivatives such as convertible debt, profit interests, preferred warrants, purchase options, securities that have unique characteristics, as mentioned below.

Characteristics (indicative list)

- Warrants convertible in next round of financing, or with different payoffs at IPO or M&A, etc.

- Convertible debt, with an option to get converted to an existing round or in a new financing round.

- Profit interest with time based and performance based vesting criteria.

- Earn outs with payoffs based on the company’s future revenues/profits.

- Incentive stock options based on company’s performance and achievement of certain milestones.

Preferred Approach

- Monte Carlo Simulation – This is one of the most dynamic models for estimating the value of securities with complex/conditional features. This method involves running a large number of simulations using random quantities for uncertain variables, and looking at the distribution of results to determine the expected value of the security. This methodology allows the modeling of securities with complex terms, where path dependency, floors, caps, triggers, change of control, down round financing provisions can be taken into account. Knowcraft Analytics uses in-licensed Crystal Ball application to run simulations.

Problem Statement

To find out the value of bridge warrants issued to investors that had an option to convert into existing round of preferred financing or the next qualified round of equity financing, whichever had a lower issue price, and exercisable in the events of IPO, M&A or expiration (also referred as end of term).

Key Assumptions

- Warrants will have the same rights as existing Series B or Series C (new financing), as applicable.

- If financing does not occur, the Company will dissolve.

- In an M&A event, the warrant will be assumed by the buyer.

- All share counts for future financing, will be developed based on OPM back-solve within the simulation.

The Knowcraft Way

We relied on Monte-Carlo simulation that enables thousands of iterations and maximum possible permutations and combinations to arrive at a probability weighted value of the security. Building the model consisted of following steps:

- Forecasting enterprise value on monthly intervals based on a log-normal distribution. Key inputs were starting enterprise value, risk-free rate and asset volatility.

- Applying Yes/No simulation to forecast whether an M&A event and/or financing takes place.

- Developing a distribution for finding out probability of occurrence of financing and probability of M&A/IPO over the term of the warrants.

- Forecasting values of warrants under each scenario i.e., end of term (“EOT”); M&A and IPO.

- Forecasting event probabilities – probability of occurrence of IPO, M&A, EOT, financing, failure, etc.

- Forecasting number of warrant shares, if the warrants exercise in new equity financing.

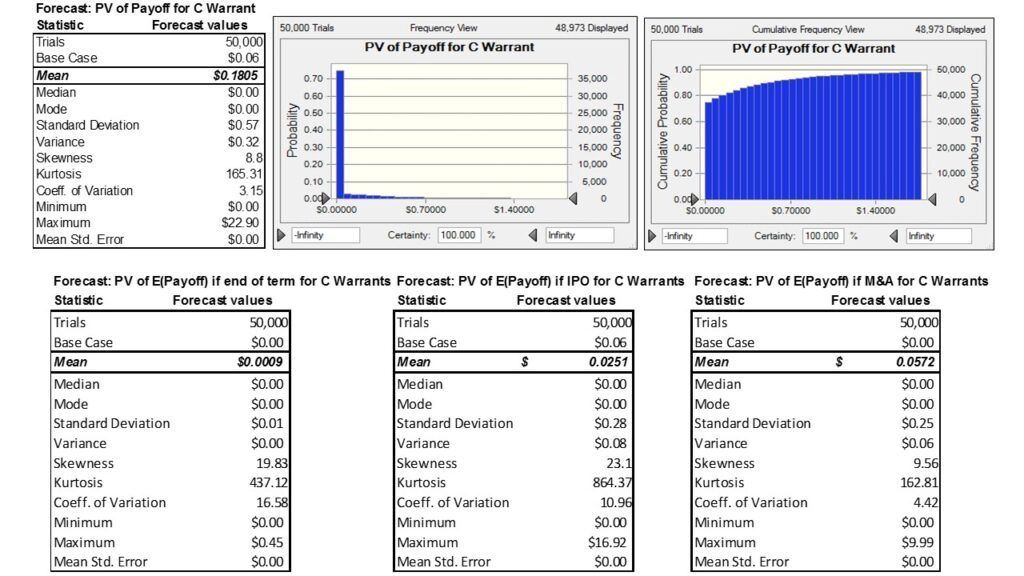

- Running 50,000 simulations to obtain results.

Snapshot of Results

*Series B/C warrants are defined as Series C warrants in the tables/charts above. However, if no financing occurs before the end of term of the warrants or if the issue price of Series C is higher than that of Series B, the warrants have the right to exercise into Series B.